Top 10 Stocks for 2026: AI Leaders, Crypto & ETFs

Major market themes—rate cuts, an AI arms race, and a broadening equity rally—are converging as investors scan for the best stocks for 2026. Consensus calls anticipate mid‑single‑digit to high‑single‑digit gains for the S&P 500 next year as earnings accelerate, with AI and automation remaining the cycle’s dominant profit drivers [1][2]. That backdrop favors quality growth and real cash flows from AI infrastructure, plus selective exposure to frontier themes (crypto, quantum, and gene editing).

This guide moves beyond tickers to the “so what”: why these names, why now, and how to combine them. You’ll get a concise macro setup, 10 researched picks (8 stocks, 2 ETFs), an allocation playbook, key risks, and answers to frequent questions—all with citations so you can dig deeper.

Table of Contents

Market Setup: What Will Drive 2026

The macro backdrop leans constructive. After a steep tightening cycle, the Federal Reserve began cutting rates in late‑2025, easing financial conditions and historically favoring growth‑oriented equities [2]. Street forecasts suggest the S&P 500 could rise ~8% in 2026, supported by positive earnings revisions, disinflation progress, and still‑resilient employment and consumer balance sheets [1]. FactSet’s consensus points to ~13.7% EPS growth for the S&P 500 next year, with leadership expected from innovation‑heavy sectors like Information Technology and Industrials [2].

At the same time, AI remains a structural, multi‑year force. Enterprises are shifting budgets toward AI infrastructure (chips, networking, accelerators) and AI‑enabled software. Microsoft’s AI‑related revenue reached an estimated $13B run‑rate in 2025 and could approach $45B in 2026, underscoring the speed at which AI monetization is scaling [3]. On the hardware side, NVIDIA is expanding capacity aggressively; supply‑chain checks indicate a path to ≥50,000 high‑end AI systems shipped in 2026 (vs. ~30,000 in 2025) as hyperscalers and large enterprises deploy generative AI at scale [4]. These trends underpin the stock ideas you’ll find below.

Takeaway: earnings leadership is forecast to cluster in innovation‑intensive sectors, reinforcing a tilt toward AI infrastructure, software, and high‑value industrials heading into 2026 [2].

Ten Stocks & ETFs to Watch in 2026

The list below blends AI infrastructure and software, frontier disruptors (crypto, genomics, quantum), and core market exposure. Each pick includes the thesis, catalysts, and a candid nod to risk.

Quick snapshot (use as a map, not a substitute for the write‑ups):

| Ticker | Name | Theme | Why it made the list (2026 catalysts) |

| TSLA | Tesla | EVs & autonomy | Robotaxi/FSD optionality; AI/robotics monetization; global EV scale [5] |

| NVDA | NVIDIA | AI infrastructure | Capacity ramp; leadership in AI accelerators; robust demand visibility [4] |

| MSFT | Microsoft | AI software & cloud | Copilot monetization; Azure AI at scale; diversified cash flows [3] |

| GOOGL | Alphabet | Search, ads, cloud AI | Resilient ads; Vertex AI/TPU; cloud profitability inflection [6] |

| PLTR | Palantir | Enterprise AI | AIP traction; government & commercial wins; agentic AI narrative [7] |

| HOOD | Robinhood | Retail investing | Higher engagement; product breadth; operating leverage [8] |

| COIN | Coinbase | Crypto adoption | Institutional flows; stablecoin rails; derivatives & staking [9] |

| CRSP | CRISPR Therapeutics | Genomics | First CRISPR therapy ramp; 2026 revenue self-funding potential [10] |

| QTUM | Defiance Quantum ETF | Quantum & ML basket | Diversified access to quantum/AI names; strong recent momentum [11] |

| SPY | SPDR S&P 500 ETF | Core index | Own the market’s earnings growth; ballast for higher-beta picks [1][2] |

Tesla (TSLA): EV Scale Meets Autonomy Optionality

Tesla blends a dominant EV footprint with outsized upside from software‑like margins in autonomy. Street scenarios around robotaxi deployment (leveraging FSD) argue for new, recurring, high‑margin revenue streams, with one prominent analyst projecting rollout to 30–35 U.S. cities in year one under a bullish execution path [5]. The same view implies up to $1T in added market value over time from AI and robotics initiatives if milestones are hit—an aggressive but instructive illustration of the upside skew [5].

Watch in 2026: regulatory approvals, FSD performance metrics, cost‑down on batteries, and software attach rates.

Risks: regulatory delays, competitive price pressure in EVs, autonomy setbacks.

NVIDIA (NVDA): The AI Compute Standard

Every enterprise rushes to add AI; most start by buying NVIDIA accelerators. Supply‑chain checks point to a meaningful capacity lift into 2026 (≥50k high‑end systems) even after raising 2025 output, while next‑gen platforms aim to extend performance leadership [4]. That keeps NVIDIA central to data‑center build‑outs and model training/serving.

Watch in 2026: product cadence (e.g., upcoming architectures), networking attach, and hyperscaler capex plans.

Risks: supply normalization, competition (notably from AMD and custom silicon), and cyclical capex pauses.

Microsoft (MSFT): Copilots, Everywhere

Microsoft is productizing AI at scale—from GitHub Copilot to Microsoft 365 Copilot to Azure’s AI platform. AI‑related revenue was estimated at a $13B run‑rate in 2025 and could approach $45B in 2026, reflecting rapid enterprise adoption [3]. Unlike pure‑plays, Microsoft pairs AI growth with diversified profits (cloud, enterprise software, gaming), dampening volatility.

Watch in 2026: Copilot seat growth, AI services GM%, and Azure AI workloads as a share of cloud revenue.

Risks: pricing/ROI scrutiny from CIOs, AI compute costs vs. monetization, regulatory headwinds.

Alphabet (GOOGL): Defending (and Monetizing) the Moat

Alphabet brings durable Search/YouTube ad engines plus Google Cloud—now profitable—into the AI era. It’s integrating AI into search experiences and commercializing Vertex AI while leveraging in‑house silicon (TPUs). Independent research highlights Alphabet’s ad resilience, cloud growth, and AI/YouTube monetization as core strengths into 2026 [6].

Watch in 2026: Search AI UX impact on ad yield, cloud growth runway, and DeepMind‑driven advances.

Risks: AI’s effect on search behavior, margin pressure from compute costs, antitrust scrutiny.

Palantir (PLTR): Enterprise AI with a Security‑Grade Edge

Palantir’s Artificial Intelligence Platform (AIP) helps enterprises run LLMs safely on private data—an attractive proposition for regulated industries and governments. A top bank recently argued Palantir’s “agentic AI” approach is a competitive differentiator, supporting >20% stock upside as adoption grows [7].

Watch in 2026: large commercial deals, federal awards, margin expansion on software scale.

Risks: lumpy contract timing, valuation sensitivity, and intense competition from hyperscalers and startups.

Robinhood (HOOD): A Levered Bet on Retail Participation

Robinhood’s model thrives on engagement cycles. As markets recovered, 2025 brought a sharp rebound: ~45% revenue growth and >100% net‑income growth amid rising trading and crypto activity, with the share price surging accordingly [8]. New products (retirement, international expansion, higher yield on cash) deepen the relationship with younger investors.

Watch in 2026: user growth/MAUs, crypto mix, net interest, and operating leverage.

Risks: high beta to risk appetite, regulatory shifts, and competition from full‑service brokers.

Coinbase (COIN): The Crypto On‑Ramp

If crypto adoption gains mainstream traction, Coinbase is the U.S. on‑ramp of record. As of late‑2025, improving sentiment, institutional participation, and policy steps (e.g., stablecoin recognition) supported renewed activity; the stock and analyst conviction both improved, with a plurality calling it a Buy [9].

Watch in 2026: trading volumes post‑halving cycle, custody wins with asset managers, international derivatives growth.

Risks: regulatory actions, crypto price volatility, fee compression.

CRISPR Therapeutics (CRSP): From Breakthrough to Business

With the first FDA‑approved CRISPR‑based therapy (CASGEVY/exa‑cel) for sickle cell disease/β‑thalassemia, CRISPR Therapeutics moves from platform promise toward commercial execution [10]. Management has framed 2025 as a ramp year and 2026 as the inflection toward self‑sustaining revenues, potentially funding a broader pipeline (oncology, diabetes) [10].

Watch in 2026: patient starts, center activations, payer dynamics, and real‑world outcomes.

Risks: uptake vs. procedure complexity/cost, manufacturing scale‑up, competitive gene‑editing modalities.

Defiance Quantum ETF (QTUM): A Basket for Next‑Wave Compute

Quantum computing may be early, but QTUM offers diversified exposure to quantum and machine‑learning names—spanning pure‑plays and enabling semis. Trailing 1‑year returns near +67% (as of late‑2025) and rising AUM reflect investor interest in the theme [11].

Watch in 2026: progress updates from IBM/Google/Amazon and specialized players; AI‑data‑center tailwinds across holdings.

Risks: long timelines to commercial quantum advantage; headline‑driven swings; concentration in high‑beta tech.

SPDR S&P 500 ETF (SPY): Own the Earnings Engine

Amid thematic bets, SPY remains the portfolio keystone—broad, liquid exposure to U.S. corporate earnings. With ~8% 2026 price appreciation in some big‑bank scenarios and ~13.7% EPS growth implied by aggregated estimates, SPY captures the most likely path while smoothing idiosyncratic risk [1][2].

Watch in 2026: breadth (beyond mega‑cap tech), margin trends, and sector leadership rotation.

Risks: macro shocks, geopolitics, and earnings compression if growth slows.

How to Build a 2026‑Ready Portfolio

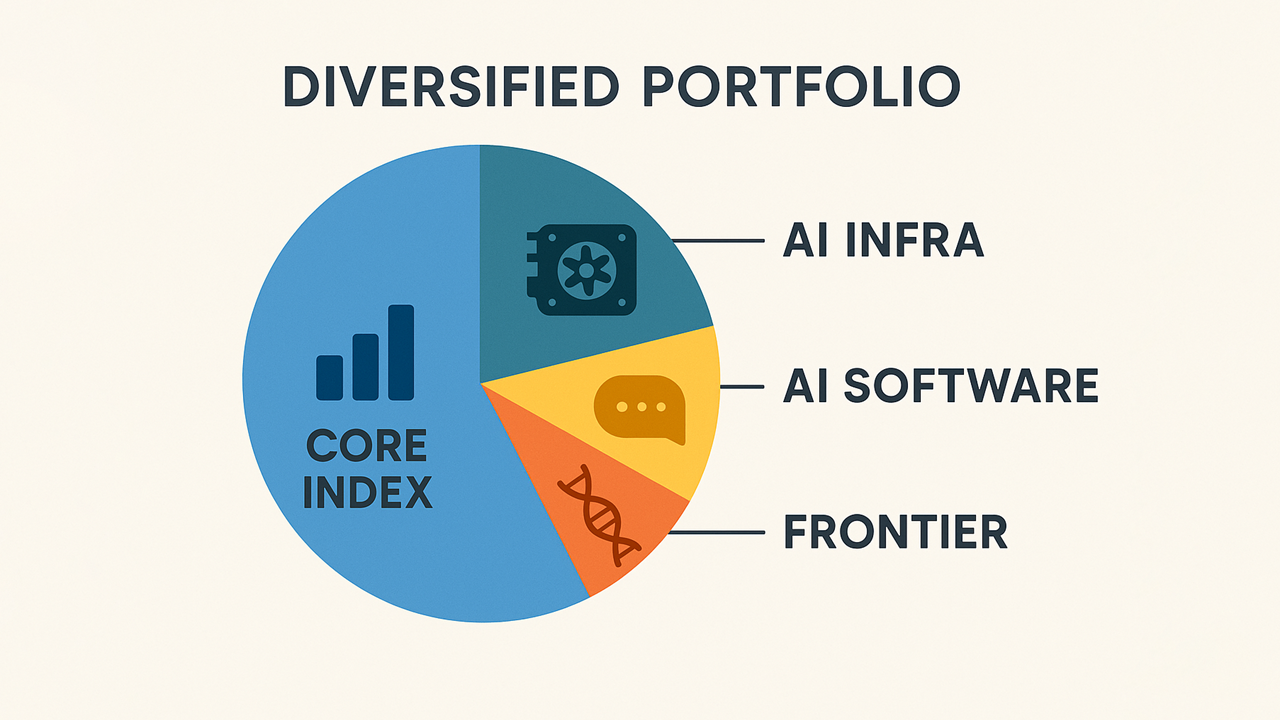

A practical 2026 allocation respects the AI super‑cycle yet anchors to diversified earnings. One straightforward framework:

Core (40–60%) — SPY as the ballast. This captures broad EPS growth and sector rotation without timing every theme [1][2].

AI infrastructure & software (20–30%) — Blend NVDA (hardware scale) with MSFT (software monetization). Add GOOGL for ads/search moats plus cloud AI [3][4][6].

Option‑like upside (10–20%) — Select TSLA for autonomy optionality, PLTR for enterprise AI penetration [5][7].

Frontier/disruptor sleeve (5–15%) — COIN (crypto adoption), CRSP (genomics commercialization), and/or QTUM (quantum/ML basket) sized to risk tolerance [9][10][11].

Two additional guardrails sharpen risk management:

Position sizing over prediction. Let high‑beta names be smaller so drawdowns don’t derail the plan.

Rebalance on catalysts (or misses). Increase/decrease weight when thesis milestones are confirmed or disproved.

This approach balances today’s cash‑flow engines with tomorrow’s optionality, consistent with the 2026 earnings skew toward innovation while acknowledging uncertainty.

Key Risks and How to Manage Them

Macro & policy. Faster‑than‑expected growth could reignite inflation and slow rate cuts; the opposite could compress earnings. Keep a core index anchor and a rebalancing discipline to navigate either path [1][2].

AI spending digestion. After a massive capex wave, enterprises could pause to absorb deployments. Mitigate by holding software monetizers (MSFT) alongside hardware providers (NVDA) and by not over‑concentrating [3][4].

Regulation. Big Tech faces antitrust scrutiny; crypto and gene editing face evolving rules. Contain exposure with diversification and position‑sizing (COIN, CRSP, PLTR smaller sleeves) [7][9][10].

Execution risk. Autonomy timelines (TSLA), enterprise AI deal cycles (PLTR), commercialization ramps (CRSP) can slip. Track milestones and be ready to trim/rotate if the thesis stalls [5][7][10].

FAQ

Is 2026 shaping up as a “good” year for stocks?

Forecasts lean moderately positive: ~8% S&P 500 appreciation paired with double‑digit EPS growth are common high‑level assumptions, though volatility is likely around elections and global headlines [1][2]. A broadening rally beyond a handful of mega‑caps would be a constructive confirmation.

How central is AI to stock selection for 2026?

Very. AI is simultaneously a capex cycle (chips, networking) and a software monetization wave (copilots, AI services). Data points like Microsoft’s AI revenue ramp and NVIDIA’s shipment pipeline illustrate both sides of the stack [3][4]. Not every “AI‑adjacent” story will pay; focus on leaders with demonstrated revenue impact.

Why include ETFs like SPY or QTUM instead of only stocks?

SPY delivers the market’s earnings engine and cushions single‑name risk. QTUM spreads exposure across early quantum/ML players where picking a single winner is difficult; its recent performance shows how a basket can capture theme momentum while reducing idiosyncratic risk [11].

Aren’t Tesla and Coinbase too volatile?

They are high beta and should be sized accordingly. Tesla’s upside is tied to autonomy milestones; Coinbase’s to crypto adoption and policy clarity [5][9]. Pairing them with core holdings (SPY) and steadier AI leaders (MSFT/NVDA) balances the overall profile.

Conclusion & Next Steps

A credible 2026 plan blends AI’s durable profit cycle with the market’s broad earnings base. The names in this guide map to that synthesis: NVIDIA/Microsoft/Alphabet as AI pillars; Tesla/Palantir for asymmetric upside; Coinbase/CRISPR Therapeutics for targeted frontier exposure; QTUM for diversified access to next‑wave compute; and SPY to anchor the journey [1][2][3][4][5][6][7][9][10][11]. The goal is not clairvoyance but probability stacking—owning leaders with clear catalysts, right‑sizing risk, and letting time in the market compound results.

Choose the sleeves that fit your risk tolerance, write down the specific catalysts you’re watching for each holding, and set quarterly check‑ins to rebalance. In fast‑moving themes like AI and crypto, a written plan beats guesswork—and positions you to act when 2026 delivers its surprises.

About the Author

Harry Negron is the CEO of Jivaro, a writer, and an entrepreneur with a strong foundation in science and technology. He holds a B.S. in Microbiology and Mathematics and a Ph.D. in Biomedical Sciences, with a focus on genetics and neuroscience. He has a track record of innovative projects, from building free apps to launching a top-ranked torrent search engine. His content spans finance, science, health, gaming, and technology. Originally from Puerto Rico and based in Japan since 2018, he leverages his diverse background to share insights and tools aimed at helping others.