Blockchain Explained: From Ledgers to Real‑World Impact

A decade ago, “blockchain” evoked images of shadowy coders and volatile coins. Today, governments trace medical supplies on distributed ledgers, global brands verify diamonds on‑chain, and retail investors buy fractions of Bitcoin from a smartphone. Yet confusion lingers: Is blockchain just a fancy spreadsheet, endless hype, or something truly new?

At its heart, a blockchain is a shared ledger that replaces corporate gatekeepers with mathematics, cryptography, and open consensus [1]. Remove the jargon and you reveal a simple—though ingenious—system that any motivated reader can grasp. This guide dissects that system step by step, compares flagship networks, explores real‑world applications, and shows you two beginner‑friendly paths to experience the technology yourself.

Let’s dive in.

Table of Contents

How Blockchains Build Trust Without Middlemen

Blockchains solve an age‑old coordination dilemma: How can strangers agree on a single version of events without trusting a central referee? Traditional databases answer with hierarchy—one administrator writes the truth. Blockchains flip the model. They copy the ledger to thousands of computers (nodes) worldwide and require collective agreement before any new entry sticks [2].

This architecture produces three game‑changing traits:

Decentralisation – No single entity can quietly rewrite history; power is distributed.

Immutability – Every block carries the cryptographic fingerprint of its predecessor. Changing old data would break the entire chain and be rejected by honest nodes [3].

Transparency with pseudonymity – Transactions are publicly visible, yet users remain identified only by cryptographic addresses, balancing auditability and privacy [4].

Because the rules are open source and enforcement is algorithmic, blockchains enable peer‑to‑peer digital money, censorship‑resistant record‑keeping, and automated contracts—all without asking anyone’s permission.

Inside a Block: Data, Hashes, and Cryptographic Links

Imagine a block as a tamper‑evident container of information. Typical contents include:

| Field | What It Does |

| Timestamp | Records when the block was created |

| Transaction List | Payments, messages, or smart‑contract calls |

| Previous Block Hash | Fingerprint linking back to the prior block |

| Merkle Root | Compact hash summarising every transaction |

| Nonce / Validator Signature | Proof the creator followed network rules |

When transactions fill the container, nodes seal it with a unique hash—essentially a digital fingerprint created by passing the block’s data through a one‑way algorithm. Any later tweak, even a single byte, changes the hash entirely. Because that hash is saved in the header of the next block, falsifying history would require recalculating every subsequent hash faster than honest participants can add new blocks. On large networks like Bitcoin, such an attack would demand billions in hardware and electricity—an almost impossible feat [5].

Merkle trees offer further efficiency. They hash transactions pairwise, then hash those hashes, building a binary tree that lets nodes verify a single payment exists without downloading the whole dataset [6]. This design keeps full nodes manageable on consumer hardware while preserving end‑to‑end integrity.

Consensus Mechanisms: PoW, PoS, and Beyond

Thousands of nodes must stay in sync despite latency, dishonesty, or power outages. Consensus algorithms coordinate that dance.

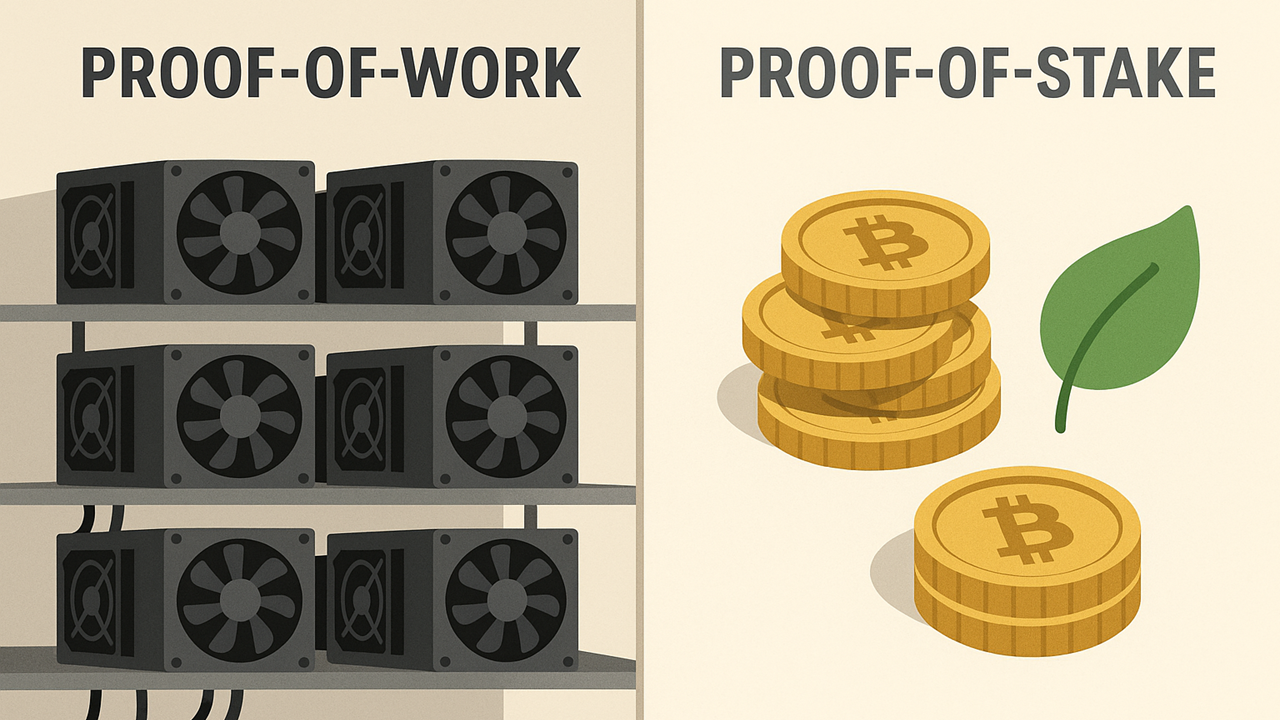

Proof‑of‑Work (PoW)

Bitcoin pioneered PoW: miners race to find a nonce that, when hashed with the block header, yields a hash below a target number. First past the post earns newly minted coins and network fees [7]. PoW’s economic cost—electricity—makes attacking the chain ruinously expensive, but critics note its large energy footprint.

Proof‑of‑Stake (PoS)

Ethereum’s 2022 “Merge” replaced mining with staking. Validators lock ETH as collateral; the protocol randomly selects one to propose a block while others attest to its validity. Dishonest actors lose part of their stake (slashing) [8]. PoS reduces energy usage by >99 % and enables faster confirmation times.

Hybrid and Novel Designs

Proof‑of‑History + PoS (Solana) – Adds cryptographic timestamps, allowing parallel processing and theoretical throughput over 50 000 tps [9].

BFT‑Style PoS (Cosmos / Tendermint) – Fast finality after two rounds of voting, ideal for cross‑chain transfers [10].

Different mechanisms optimise for security, speed, and decentralisation along a sliding scale. No single model is perfect; diverse applications demand diverse trade‑offs.

Major Public Networks and What Sets Them Apart

Blockchains are not interchangeable. Each leading network embodies unique goals and engineering choices.

Bitcoin: Scarcity and Security

Launch: 2009

Consensus: Proof‑of‑Work

Supply Cap: 21 million BTC

Designed as digital gold, Bitcoin sacrifices speed for unmatched security and decentralisation. Average settlement takes 10 minutes, yet its predictable issuance and censorship resistance drive adoption as a long‑term store of value [11].

Ethereum: Programmable Money

Launch: 2015

Consensus: Proof‑of‑Stake (since 2022)

Innovation: Smart contracts

Ethereum transformed blockchains into a global computer where code self‑executes. This flexibility birthed DeFi, NFT marketplaces, and DAOs. Network upgrades (sharding, rollups) aim to solve congestion while preserving decentralised security [12].

Solana: High‑Speed Applications

Launch: 2020

Consensus: PoH + PoS

Throughput (theoretical): 50 000 tps

Solana targets high‑frequency trading, on‑chain gaming, and real‑time apps. Faster blocks mean lower latency but require powerful validator hardware, sparking debate over decentralisation levels [13].

Dogecoin: Community Currency

Initially a joke, Dogecoin now facilitates micro‑tips and charity drives. Its friendly social media culture proves that community sentiment can translate into real economic activity on an open ledger [14].

Cosmos: Inter‑Blockchain Communication

Cosmos provides a toolkit for sovereign chains that speak a common language (IBC). Developers get custom blockchains without siloing assets; users get frictionless transfers between ecosystems [15].

Taken together, these networks illustrate blockchain’s breadth: hard‑capped money, programmable finance, ultra‑fast apps, meme economies, and an internet of interoperable ledgers.

Practical Uses Far Beyond Cryptocurrency

Cryptocurrencies grabbed headlines first, but blockchain’s underlying traits—immutability, transparency, automation—solve problems in many industries.

Supply‑Chain Provenance

Walmart and IBM Food Trust cut mango trace times from seven days to 2.2 seconds by recording each hand‑off on Hyperledger Fabric [16]. The result: faster recalls, fewer counterfeit goods, and greater consumer trust.

Self‑Sovereign Identity

Microsoft’s ION anchors decentralised identifiers (DIDs) to Bitcoin. Users store credentials (age, degree, licence) locally and present zero‑knowledge proofs when needed, slashing reliance on hack‑prone central databases [17].

Healthcare Interoperability

MIT’s MedRec prototype encrypts patient data pointers on Ethereum, giving individuals unified control while hospitals keep sensitive files off‑chain. Providers retrieve authorised records instantly, cutting costly repeat tests [18].

Secure Digital Voting

Since 2014, Estonia has used blockchain to harden its e‑voting system. Citizens cast ballots remotely; cryptographic proofs ensure one vote per ID, while public audit logs boost confidence in tallies [19].

Smart‑Contract Automation

In Kenya, parametric crop‑insurance policies pay farmers automatically when satellite feeds show drought conditions. Smart contracts remove paperwork delays, delivering relief within days instead of months [20].

These cases share a theme: multiple parties need a single version of truth, yet no one fully trusts the others. Blockchain supplies that neutral ground.

First Steps: Safely Buying and Using Crypto

Theory becomes clear when you transact—even $10 worth.

Open a Coinbase Account

User‑friendly design, educational mini‑courses, and insured custody make Coinbase an ideal on‑ramp. Verify identity, link a payment method, and own Bitcoin or Ether in minutes. You can later withdraw to a personal wallet for full self‑custody. If you’re an expat, Coinbase has limited access to its platform from various places around the world. Consider getting a residential proxy or a virtual private network to access it.

Trade With Robinhood

Prefer to manage stocks and crypto in one app? Robinhood offers commission‑free Bitcoin, Ether, and Dogecoin trades alongside equities. Recent wallet features let you withdraw select coins, bridging simplicity with on‑chain utility.

Practice Tip: Transfer a small amount from Coinbase to a mobile wallet, then view the transaction on a block explorer. Watching confirmations tick in real time cements your understanding of decentralized settlement.

Blockchain technology converts social trust problems into mathematical ones. By chaining cryptographic proofs and distributing the ledger, it ensures that no single actor can alter history, yet everyone can verify it. From Bitcoin’s scarcity model to Ethereum’s self‑executing contracts and Solana’s high‑speed architecture, blockchains already enable borderless payments, algorithmic lending, and transparent supply chains.

The ecosystem is still young—bugs, hacks, and regulatory questions remain—but the direction is clear: systems built on shared, tamper‑proof databases can reduce fraud, cut middle‑man fees, and give individuals greater control over assets and identity. Whether you explore with a $20 Bitcoin purchase or build the next decentralised app, engaging now offers a front‑row seat to technology’s next wave.

Open a Coinbase or Robinhood account today, move a small transaction on‑chain, and experience firsthand how blockchain turns code into trust.

References

Nakamoto S. Bitcoin: A Peer‑to‑Peer Electronic Cash System (2008).

Antonopoulos A. Mastering Bitcoin O’Reilly (2017).

De Filippi P., Wright A. Blockchain and the Law Harvard Press (2018).

Crosby M. et al. “Blockchain Technology: Beyond Bitcoin” Applied Innovation (2016).

Narayanan A. et al. Bitcoin and Cryptocurrency Technologies Princeton (2016).

Wood G. Ethereum Yellow Paper (2014).

Coin Metrics Network Data, Hashrate charts (2025).

Ethereum Foundation. “The Merge Energy Impact” (2023).

Solana Labs Whitepaper (2021).

Cosmos Hub Docs – Tendermint & IBC Overview (2024).

Yermack D. “Is Bitcoin a Real Currency?” NBER (2015).

Buterin V. “Proof‑of‑Stake FAQs” Ethereum Blog (2023).

Solana Foundation Performance Report (2024).

CoinDesk. “Dogecoin’s Rise Explained” (2021).

Interchain Foundation Annual Report (2024).

IBM Food Trust x Walmart Case Study (2022).

Microsoft ION Technical Paper (2023).

Ekblaw A. et al. “MedRec: Medical Data on the Blockchain” MIT (2022).

Republic of Estonia E‑Governance Whitepaper (2024).

Chainlink Labs. “Smart‑Contract Crop Insurance” (2023).

About the Author

Harry Negron is the CEO of Jivaro, a writer, and an entrepreneur with a strong foundation in science and technology. He holds a B.S. in Microbiology and Mathematics and a Ph.D. in Biomedical Sciences, with a focus on genetics and neuroscience. He has a track record of innovative projects, from building free apps to launching a top-ranked torrent search engine. His content spans finance, science, health, gaming, and technology. Originally from Puerto Rico and based in Japan since 2018, he leverages his diverse background to share insights and tools aimed at helping others.