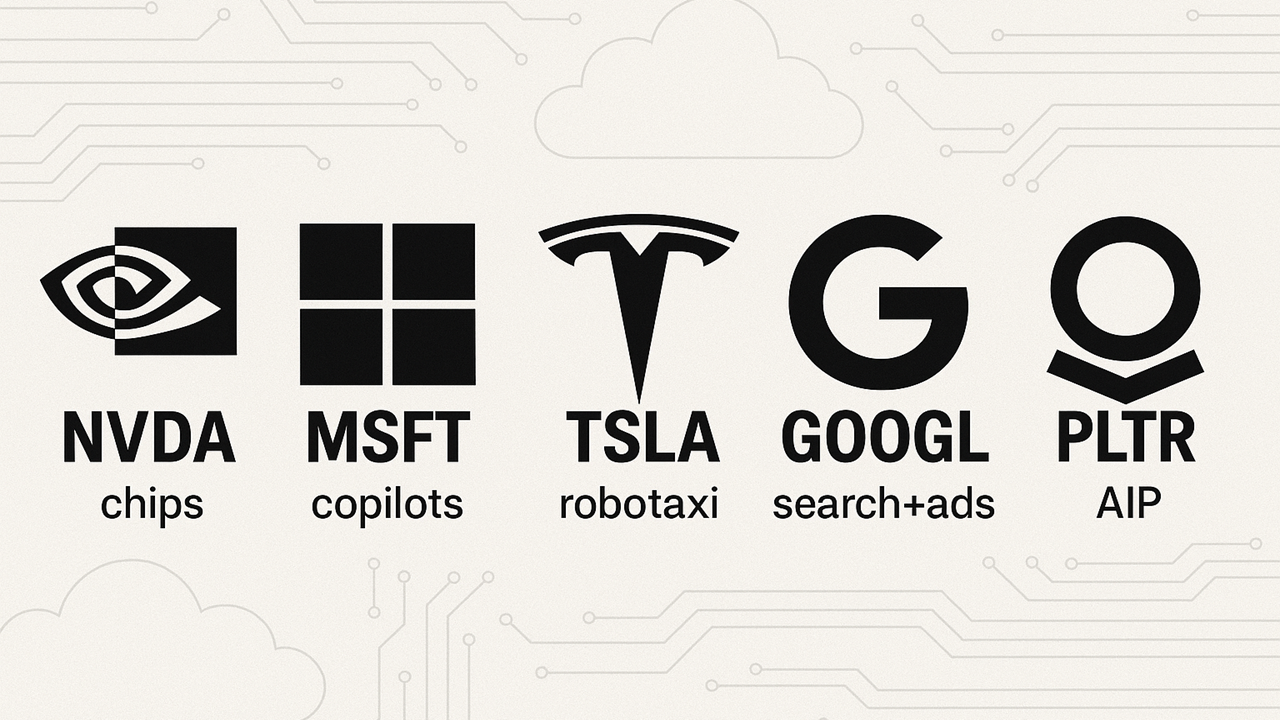

Top 10 Stocks for 2026: AI Leaders, Crypto & ETFs

Looking for the best stocks to buy for 2026? This long‑form guide distills Wall Street outlooks, AI trends, and sector forecasts into a practical short list: 8 stocks and 2 ETFs spanning chips, cloud software, EVs, fintech/crypto, gene editing, quantum—and a core index anchor. You’ll see the why behind each pick, the key risks, and a simple framework to assemble a balanced, 2026‑ready portfolio.

Investing Platforms: Groundfloor

Interested in real estate investing without the landlord headaches? Groundfloor lets you invest in short-term property loans with as little as $10, earning potential annual returns ranging from around 6% to 14%. You’ll fund projects secured by real estate—no fixing burst pipes or chasing down rent checks—while enjoying a user-friendly platform and the freedom to diversify across multiple deals. Just remember, there’s still risk involved, and liquidity is limited until each loan matures.

Jivaro’s Baby Steps to Erase Debt & Build Wealth

Achieving financial freedom is about more than just eliminating debt—it’s about building lasting cash flow. Follow these 9 actionable steps to accelerate your journey, combining debt payoff with income stream creation and investment growth. From budgeting and side hustles to dividends and real estate, learn how to secure financial independence and live the life you deserve.

Investing Basics: What is Compounding

Compound interest turns small, consistent investments into significant wealth by reinvesting your returns. This guide explains compounding’s powerful growth formula, illustrates its impact on savings, stocks, and bonds, and offers strategies to avoid pitfalls like inflation and fees. Start harnessing this financial superpower today to build long-term wealth effortlessly.

The Financial Independence, Retire Early (FIRE) Movement

Join the Financial Independence, Retire Early (FIRE) movement to achieve financial freedom faster. This guide explains exactly how to build a passive income stream of $3,000 per month, from dividend stocks and real estate investments to bonds and peer-to-peer lending. Start your journey toward early retirement with practical tips, investment insights, and financial strategies today.

Investing Platforms: Robinhood

Thinking about switching to Robinhood? This in-depth review covers the real-world experience of managing a $1.3M portfolio on the platform. Discover its benefits like commission-free trades, fractional shares, and crypto access—alongside drawbacks like limited research tools and slower support. Get a full picture to decide if Robinhood suits your investing style.

Beginner’s Guide to Investing

Parking cash in a current account slowly erodes buying power. This guide shows why adopting an investor mind‑set matters, explains core assets from stocks to REITs, and maps an 80/15/5 starter portfolio. Learn discipline tools like dollar‑cost averaging, rebalancing, and automation, then follow eight clear steps—from opening a brokerage to quarterly reviews—to launch your long‑term wealth engine.

Investing Platforms: Coinbase

Coinbase simplifies crypto investing with its intuitive, user-friendly platform ideal for beginners and seasoned traders alike. With robust security, including offline asset storage and regulatory compliance, Coinbase ensures safe trading of Bitcoin, Ethereum, and over 240 digital assets. Learn about its basic and advanced trading interfaces, staking rewards, and educational tools today.

Debt Repayment: The Avalanche Method

The debt avalanche strategy destroys the most expensive balances first, saving borrowers thousands in interest charges and months—sometimes years—of payoff time. Learn the science, the psychology, and the real‑life income tactics that turn an overwhelming credit‑card pile into a zero balance.

How Much Can Bringing Lunch to Work Save You?

Buying coffee and lunch at the office feels harmless, yet the habit can drain $3,000 or more annually. See the real maths, learn practical meal‑prep tips, and discover how investing those savings turns sandwiches into long‑term wealth.

Generate Passive Income by Sharing Your Internet Bandwidth With These Apps

In today's digital age, sharing your bandwidth has become a new way to earn money. Companies are looking for ways to leverage unused bandwidth to power their services, and you can benefit from this trend by earning passive income. By sharing your bandwidth, you can earn money and help companies provide better internet services to their customers.

Becoming a Millionaire with Side Hustles

This blog documents a personal challenge to build a $1 million portfolio from scratch using only side hustle income. From Runescape scripting to YouTube, every dollar is earned and reinvested in ETFs, stocks, bonds, and peer-to-peer lending. With transparent monthly updates and a strict no-liquidation rule, this journey proves financial growth is possible with creativity and dedication.

Becoming a Millionaire with Side Hustles (May 2025)

In this May 2025 update, Harry Negron shares how treating Fanconi’s Syndrome boosted his productivity—and helped generate $7,317 in remote side hustle income. From voice training on Alignerr to data annotation, YouTube growth, and giveaways across Discord and Niigata, it’s a creative month of gains. With a portfolio now at $16,174, the millionaire mission moves closer.

Is It Okay to Take a Car Loan?

Learn how different car loan scenarios impact your finances, how much interest can really cost you, and why short-term, low-interest loans or cash purchases might be your best path to long-term wealth.

Dollar Cost Average (DCA) Explained

Dollar-cost averaging (DCA) is a steady investment strategy that helps reduce timing risk and emotional decision-making. Instead of investing all your money at once, you spread it out over time with regular contributions—buying more when prices dip and less when they rise. This guide breaks down how DCA works, where it thrives, and how it compares to lump-sum investing in different market conditions.

Investing Platforms: Fidelity

Fidelity is a top-rated brokerage offering zero-commission trading, robust retirement options, powerful trading platforms, and banking features all in one place. This in-depth review covers everything you need to know in 2025—from mutual funds and crypto access to IRAs and managed accounts. Whether you’re a beginner or a seasoned investor, Fidelity remains a top-tier choice for building long-term wealth.

Low Volatility Margin Trading: A Daily 1–3% Stock Trading Approach

Looking to avoid high-stress, high-volatility day trading? Low-volatility margin trading targets 1–3% daily gains by exploiting small intraday price swings in stable, liquid stocks. This guide breaks down the exact strategy—entry points, sector focus, risk controls, and compounding power—so you can trade with discipline and consistency while avoiding the chaos of big swings or speculative plays.

The 20-Year Half a Million Plan (That The Average Person Can Do)

Think a half-million dollars is out of reach? With just $550/month, compound interest, and low-cost index funds, you can reach $500,000 in 20 years. This guide explains how to start investing, pick the right funds (like VOO or VTI), automate contributions, and grow your money—without needing a high income or risky stock picks. Start today and secure your financial future.

How Credit Scores Actually Work in the U.S.

Credit scores are crucial three-digit numbers that can shape many financial opportunities—from securing a loan to renting an apartment. Here’s an in-depth look at how U.S. credit scores are calculated and why they matter, plus tips on keeping yours in top shape.

Credit Card Myths People Should Not Fall For

From misconceptions about carrying a balance to fears over checking your credit report, myths about credit cards can lead to costly mistakes. This guide debunks eight major myths, clarifies how credit scores work, and shares tips for maximizing rewards and minimizing risk. Learn how to use credit cards wisely and unlock their full financial benefits.